| Stock Exchange | Symbol |

| Pakistan Stock Exchange | LOTCHEM |

COMPANY AUDITOR

M/s. A.F. Ferguson & Co.,

Chartered Accountants.

SHARE REGISTRAR

M/s. Famco Associate (Pvt) Limited

8-F, Next to Hotel Faran, Nursery,

Block-6, P.E.C.H.S., Shahrah-e-Faisal,

Karachi

FREE FLOAT OF THE COMPANY SHARES

Click here to see the full table of shares.

ANNUAL REPORTS

| Annual Report 2015 [PDF 6.2MB] |

| Annual Report 2014 [PDF 7.2MB] |

| Annual Report 2013 [PDF 5.1MB] |

| Annual Report 2012 [PDF 11.2MB] |

| Annual Report 2011 [PDF 14MB] |

| Annual Report 2010 [PDF 3MB] |

QUARTERLY REPORTS

| Quarterly Report Ending 31 March 2015 [PDF 632KB] |

| Quarterly Report Ending 30 September 2014 [PDF 403KB] |

| Quarterly Report Ending 30 June 2014 [PDF 278KB] |

| Quarterly Report Ending March 2014 [PDF 315KB] |

| Quarterly Report Ending September 2013 [PDF 425KB] |

| Quarterly Report Ending June 2013 [PDF 492KB] |

| Quarterly Report Ending March 2013 [PDF 1MB] |

|

Mr. Changgyou KimChairmanMr Kim was appointed to the Board in December 2012. Mr Kim started his career in Honam Petrochemical in 1978 after completing his bachelor’s degree in Industrial Chemistry from Seoul National University, Korea. He went on to pursue a master’s and a PhD degree in Chemical Engineering at University of South Carolina, USA. After receiving his doctorate in 1990, he started working at Hyundai Petrochemical Corporation. In 2005, Mr Kim joined Honam Petrochemical Daeduk Research Institute where he served as the Head of Institute and Managing Director. In February 2012, Mr Kim was appointed as the CEO of KP Chemical Corporation; following the company’s merger, he was appointed Head of the Aromatics Business Division at LOTTE Chemical Corporation. Mr Kim is also the Vice Chairman of the Polymer Society of Korea. Mr Kim received the President Award in the first chemical industry day. His other directorships include serving in Lotte Chemical UK Limited and Hanju Co. Limited |

|

Mr. Jung Neon KimChief ExecutiveMr Kim was appointed to the Board in September 2009 and was re-elected in June 2011. Mr Kim has been working with LOTTE Chemical Corporation, formerly KP Chemical Corporation, Korea since 1991. He stayed in the Singapore Branch from 1996 to 2000. He’s been in the PET business since 2001 and in PTA sales for more than ten years with LOTTE Chemical Corporation. Mr Kim holds a bachelor’s degree in Economics from Pusan National University in Korea. Mr Kim also completed a short MBA programme at Seoul National University and is a certified Director of Corporate Governance from Pakistan Institute of Corporate Governance (PICG). His other directorships include serving in Lotte Powergen (Pvt) Limited. |

|

Mr. Oh Hun ImDirectorMr Im was appointed to the Board in September 2009 and was re-elected in June 2011. Mr Hun Im has been working with LOTTE Chemical Corporation, formerly KP Chemical Corporation, Korea since 1992. The same year he received his bachelor’s degree in Chemical Engineering from Yeungnam University, Korea. Mr Im has been involved in various functions at LOTTE Chemical Corporation including technical, new projects and plant management and planning. He is a certified Director of Corporate Governance from Pakistan Institute of Corporate Governance (PICG). His other directorships include serving in Lotte Powergen (Pvt) Limited and Karachi American School. Since 2009, he’s also been a member of the Korea-Pakistan Association. |

|

Mr. Mohammad Qasim KhanDirectorMr Khan was appointed to the Board in September 2009 and was re-elected in June 2011. Mr Khan is currently Business Unit President for PepsiCo International in Bangkok. He is responsible for PepsiCo’s beverage and food businesses in Japan, Korea, Philippines and Pakistan. He has been with the company since 1986, serving diverse roles in Australia, New Zealand, Vietnam, Malaysia, Singapore, Thailand and the Pacific Islands. Prior to PepsiCo, Mr Khan worked for Procter & Gamble based in Geneva, Switzerland, where he was responsible for the Arabian Gulf markets. Mr Khan has an MBA in Marketing from the USA. His current directorships include serving in Kirin Tropicana Inc., Pepsi-Cola Products Philippines, Inc., Pepsi-Cola Korea Co., Limited, and Pepsi-Cola Far East Trade Development Co. Inc. |

|

Mr. Istaqbal MehdiDirectorMr Mehdi was appointed to the Board in June 2013. He has held several roles throughout his professional career. From 2009 onwards, he served as Chairman and Chief Executive of Al-Aman Holding Pvt. Ltd. Prior to that, he was a Managing Director at Pakistan Kuwait Investment Company (Private) Limited. Some of his other roles include: serving as President and Chief Executive Officer at Zarai Taraqiati Bank Limited, Chairman and Chief Executive Officer at Agriculture Development Bank of Pakistan and Managing Director at Investment Corporation of Pakistan. He began his career in 1967 as a Research Assistant at USAID Lahore. He holds a Master’s of Philosophy in financial economics from the University of Leeds, UK. He also holds Bachelor’s and Master’s of Arts degrees in Economics from Government College, Lahore. In 1982, Mr Mehdi completed a course in public enterprise policy in developing countries from Harvard University. |

|

Mr. Hun Ki LeeDirectorMr. Lee is head of Corporate planning division at Lotte Corporation. Mr. Ki holds a Bachelors Degree in Chemical Engineering from Seoul University. He has previously served as MD and CEO of Lotte Chemical Titan and Director of overseas business development, Lotte Chemical Corporation. Other designations held by Mr. Ki include team leader of overseas business development- Lotte Corporation, Manager Corporate planning team- Lotte Chemical and Manager Business development team- Lotte Chemical |

|

Mr. Pervaiz AkhtarDirectorMr. Pervaiz Akhtar was elected to the Board of Directors of LCPL in June 2014. Mr. Akhtar is currently Director of METRO– Habib Cash & Carry Pakistan (Pvt ) Ltd at Lahore. He is responsible for METRO’s Corporate Affairs matters since 2007, being part of the senior management team he has contributed towards successfully establishing the METRO Cash & Carry’s business in Pakistan. Prior to joining METRO he served as General Manager Corporate Affairs for a Dutch Multinational Company (SHV Energy) for over 9 years. Mr. Pervaiz Akhtar has a versatile experience of more than 30 years of working with local and multinational companies in Pakistan. During this period he served in senior management positions in the field of Finance, Human Resources, Procurement and Corporate Affairs. His current Directorships besides METRO include serving in German Pakistan Trade & Investment and Star Farm Pakistan (Pvt) Limited. Mr. Akhtar represents METRO at Karachi, Lahore, Faisalabad and Islamabad Chambers of Commerce & Industry. Mr. Akhtar graduated in 1976 from University of Punjab with majors in Economics. He later attended an M.B.A program at School of Business and Commerce Islamabad and secured distinction in Business Policy & Strategy and Human Resource Management. He completed his professional training with Klynveld Peat Marwick Goerdeler (KPMG) and passed Institute of Chartered Accountants of Pakistan (Inter) examination in 1981. In 1989 Mr. Akhtar was awarded a USAID scholarship and he completed Petroleum Management Program at Arthur D. Little Inc Boston, U.S.A |

|

Mr. Hyun Chul ParkDirectorMr. Park, is Executive Managing Director at Lotte Corporate Head Office. Prior to this he was Chief of Lotte Corporate Head office. Mr. Park also holds Directorship at Lotte International co. Ltd, Hyundai Information Technology and Lotte Chemical USA Corporation. Mr. Park holds a Bachelors degree in Statistics from Kyungpook National University. |

Business principles

- Each employee should implement the Company’s core Values, comply with

and observe applicable laws, support fundamental human rights and give due regards to health, safety and environment.

Business integrity

- Bribery and other form of unethical business practices are prohibited

- Free enterprise is promoted and strict compliance with competition

laws is required - As a responsible corporate citizens, participation in community

activities is encouraged and all measures are taken for the safety and health of employees as well as for the protection of the environment - Employees are expected to maintain confidentiality and to act in the

Company’s interest at all times

Company responsibilities

- Adopt the spirit of open communication

- Provide equal opportunities and a healthy, safe and secure

environment - Ensure the rights of employees to join unions/associations

- Protect personal data of employees

- Engage in an active performance management system

Employee responsibilities

The Code provides guidance to employees on their responsibilities in the following areas:

- Media relations and disclosures

- Inside information

- Corporate identity

- Protecting intellectual property

- Internet USE

- Business travel policy

- Prohibition on substance abuse

| As at December 31, 2012 | ||

| Shareholders category | No. of Shareholders | No. of Shares held |

| Associated Companies, Undertakings and Related Parties: | ||

| KP CHEMICAL CORPORATION | 1 | 1,135,860,105 |

| NIT and ICP (name wise detail) | ||

| NATIONAL BANK OF PAKISTAN,TRUSTEE DEPARTMENT NI(U)T FUND | 1 | 16,351,072 |

| Directors, CEO and their spouse and minor children (name wise detail) | ||

| MR. SOON HYO CHUNG | 1 | 1 |

| MR MOHAMMAD ASIF SAAD (345) | 1 | 396 |

| MR. CHANGGYOU KIM | 1 | 1 |

| MR. JUNG NEON KIM | 1 | 1 |

| MR. OH HUN IM | 1 | 1 |

| MR. MOHAMMAD QASIM KHAN | 1 | 1 |

| MS. ALIYA YUSUF | 1 | 1 |

| MR. MANZOOR AHMED | 1 | 1 |

| Executives | 1 | 300 |

| Mutual Funds | ||

| CDC – Trustee AKD Aggressive Income Fund – MT | 1 | 20,000 |

| CDC – Trustee AKD Index Tracker Fund | 1 | 87,452 |

| CDC – Trustee Alfalah GHP Alpha Fund | 1 | 314,500 |

| CDC – Trustee Alfalah GHP Value Fund | 1 | 500,000 |

| CDC – Trustee Faysal Asset Allocation Fund | 1 | 500,000 |

| CDC – Trustee Faysal Balance Growth Fund | 1 | 200,000 |

| CDC – Trustee HBL – Stock Fund | 1 | 562,500 |

| CDC – Trustee KASB Asset Allocation Fund | 1 | 126,500 |

| CDC – Trustee KSE Meezan Index Fund | 1 | 287,833 |

| CDC – Trustee MCB Dynamic Stock Fund | 1 | 1,040,000 |

| CDC – Trustee NIT-Equity Market Opportunity Fund | 1 | 4,223,657 |

| CDC – Trustee Pak Strategic Alloc Fund | 1 | 125,000 |

| CDC – Trustee Pakistan Capital Market Fund | 1 | 125,000 |

| CDC – Trustee Pakistan Stock Market Fund | 1 | 1,355,000 |

| CDC – Trustee HBL Islamic Stock Fund | 1 | 654,998 |

| CDC – Trustee NAFA Savings Plus Fund – MT | 1 | 671,000 |

| CDC – Trustee Pakistan Premier Fund | 1 | 625,000 |

| Confidence Mutual Fund Ltd | 1 | 30 |

| Dominion Stock Fund Limited | 1 | 750 |

| First Capital Mutual Fund Limited | 1 | 10,000 |

| Golden Arrow Selected Stocks Fund | 1 | 30 |

| Growth Mutual Fund Limited | 1 | 75 |

| MC FSL – Trustee Askari Islamic Asset Allocation Fund | 1 | 194,476 |

| MCBFSL – Trustee Namco Balance Fund – MT | 1 | 512,000 |

| MCBFSL – Trustee Namco Income Fund – MT | 1 | 34,500 |

| MCBFSL – Trustee Pak Oman Advantage Asset Allocation Fund | 1 | 1,000,000 |

| MCBFSL – Trustee Pak Oman Advantage Asset Allocation Fund | 1 | 1,000,000 |

| Safeway Mutual Fund Limited | 1 | 1,050 |

| Security Stock Fund Limited | 1 | 150 |

| Public Sector Companies and Corporations | 5 | 2,271,329 |

| Banks, Development Finance Institutions, Non-Banking Finance Institutions, Insurance Companies, Takaful, Modaraba and Pension Funds | 50 | 45,967,820 |

| Others | 225 | 59,028,225 |

| Individuals | 19,709 | 240,556,453 |

| TOTAL | 20,029 | 1,514,207,208 |

| Shareholders holding 10% or more voting interest | ||

| KP Chemical Corporation | 1 | 1,135,860,105 |

| S. No. | Shareholders Category | No. of Shareholders | No. of Shares | Percentage % |

| 1 | Associated Companies, Undertakings and Related Parties |

1 |

1,135,860,105 |

75.01 |

| 2 | NIT and ICP |

1 |

16,351,072 |

1.08 |

| 3 | Directors, CEO and their Spouses |

8 |

403 |

0.00 |

| 4 | Executives |

1 |

300 |

0.00 |

| 5 | Public Sector Companies and Corporations |

5 |

2,271,329 |

0.15 |

| 6 | Mutual Funds |

29 |

14,171,501 |

0.94 |

| 7 | Banks, Development Finance Institutions, Non-Banking Finance Institutions, Insurance Companies, Takaful, Modaraba and Pension Funds |

50 |

45,967,820 |

3.04 |

| 8 | Others |

225 |

59,028,225 |

3.90 |

| 9 | Individuals |

19,709 |

240,556,453 |

15.88 |

| TOTAL |

20,029 |

1,514,207,208 |

100.00 |

5 YEARS AT A GLANCE

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | ||

| PROFIT & LOSS SUMMARY | |||||||

| Revenue | Rs 000 | 52,823,257 | 57,577,198 | 42,401,588 | 37,851,240 | 32,936,220 | 28,467,346 |

| Cost of sales | Rs 000 | 53,037,852 | 50,914,635 | 35,371,568 | 31,954,429 | 32,067,881 | 27,1 17,299 |

| Gross (loss) / profit | Rs 000 | (214,595) | 6,662,563 | 7,030,020 | 5,896,811 | 868,339 | 1,350,047 |

| Distribution & selling expenses | Rs 000 | 132,519 | 197,208 | 109,983 | 121,252 | 56,422 | 16,588 |

| Administration expenses | Rs 000 | 304,659 | 330,463 | 268,291 | 215,709 | 201,069 | 160,907 |

| Other operating expenses | Rs 000 | 22,346 | 502,492 | 605,923 | 543,351 | 40,850 | 38,371 |

| Other operating income | Rs 000 | 304,015 | 22,883 | 10,532 | 196,646 | 153,776 | 169,015 |

| Operating (loss) / profit | Rs 000 | (370,104) | 5,655,283 | 6,056,355 | 5,213,145 | 723,774 | 1,303,196 |

| Finance income | Rs 000 | 269,970 | 785,700 | 882,466 | 260,800 | – | – |

| Finance costs | Rs 000 | 146,054 | 232,437 | 229,225 | 754,702 | 2,402,464 | 1,103,785 |

| (Loss) / profit before taxation | Rs 000 | (246,188) | 6,208,546 | 6,709,596 | 4,719,243 | (1,678,690) | 199,411 |

| Taxation | Rs 000 | (62,471) | 2,031,015 | 2,184,275 | 1,145,537 | (108,658) | 68,044 |

| (Loss) / profit alter taxation | Rs 000 | (183,717) | 4,177,531 | 4,525,321 | 3,573,706 | (1,570,032) | 131,367 |

| EBITDA | Rs 000 | 1,265,137 | 7,757,723 | 8,184,628 | 6,679,833 | 1,917,500 | 2,478,736 |

| BALANCE SHEET SUMMARY | |||||||

| Issued, subscribed & paid-up capital | Rs 000 | 15,142,072 | 15,142,072 | 15,142,072 | 15,142,072 | 15,142,072 | 15,142,072 |

| Capital reserves | Rs 000 | 2,345 | 2,345 | 2,345 | 2,345 | 2,345 | 2,345 |

| Accumulated loss | Rs 000 | (3,002,538) | (2,061,717) | (5,482,144) | (9,250,361) | (12,886,397) | (1 1,316,365) |

| Long term loans | Rs 000 | – | – | 3,437,500 | 5,322,397 | 4,996,687 | 3,879,697 |

| Current liabilities | Rs 000 | 8,044,974 | 9,616,196 | 8,054,478 | 5,750,627 | 5,666,835 | 7,103,252 |

| Fixed assets | Rs 000 | 6,051,127 | 9,852,587 | 8,754,209 | 9,201,314 | 9,952,791 | 10,745,850 |

| Long term investment | Rs 000 | 4,500,000 | – | – | – | – | – |

| Current assets | Rs 000 | 10,310,492 | 13,900,632 | 13,896,908 | 9,543,763 | 5,149,368 | 6,393,459 |

| CASH FLOW SUMMARY | |||||||

| Operating activities | Rs 000 | 638,008 | 2,208,812 | 5,630,598 | 7,051,345 | 542,405 | 1,170,553 |

| Investing activities | Rs 000 | (2,067,451) | (1,956,139) | (1,305,449) | (277,436) | (272,730) | (227,221) |

| Financing activities | Rs 000 | (2,850,674) | (2,657,730) | (2,852,781) | (97,791) | (777,349) | (1,427,291) |

| Cash and cash equivalents at year end | Rs 000 | 225,134 | 4,505,251 | 6,910,308 | 5,437,940 | (1,238,178) | (730,504) |

| KEY RATIOS | |||||||

| Gross profit ratio | % | (0.41) | 11.57 | 16.58 | 15.58 | 2.64 | 4.74 |

| EBITDA margin to sales | % | 2.40 | 13.47 | 19.30 | 17.65 | 5.82 | 8.71 |

| Net profit margin | % | (0.35) | 7.26 | 10.67 | 9.44 | (4.77) | 0.46 |

| ROE | % | (1 .51) | 31.93 | 46.83 | 60.63 | (69.53) | 3.43 |

| ROCE | % | (1.51) | 31.84 | 33.99 | 30.89 | (20.51) | 1.60 |

| Inventory turnover | times | 11.59 | 13.90 | 18.00 | 25.38 | 17.87 | 8.97 |

| Inventory turnover in days | days | 31.48 | 26.25 | 20.27 | 14.38 | 20.42 | 40.70 |

| Debtors turnover | times | 16.40 | 18.94 | 17.90 | 26.19 | 16.85 | 15.71 |

| Average collection period | days | 22.26 | 19.27 | 20.40 | 13.94 | 21.66 | 23.23 |

| Creditors turnover | times | 10.04 | 11.03 | 10.50 | 12.21 | 9.57 | 6.88 |

| Payable turnover in days | days | 36.35 | 33.09 | 34.76 | 29.89 | 38.14 | 53.06 |

| Operating cycle | days | 17.40 | 12.44 | 5.91 | (1.57) | 3.94 | 10.87 |

| Total asset turnover | times | 2.35 | 2.47 | 2.04 | 2.22 | 2.03 | 1.63 |

| Fixed asset turnover | times | 6.64 | 6.19 | 4.72 | 3.95 | 3.18 | 2.54 |

| Current ratio | times | 1.28 | 1.45 | 1.73 | 1.66 | 0.91 | 0.90 |

| Quick ratio | times | 0.63 | 0.89 | 1 .33 | 1.37 | 0.59 | 0.49 |

| Interest cover | times | (2.53) | 24.33 | 26.42 | 6.91 | 0.30 | 1.18 |

| Debt equity ratio | times | 1.00 | 1.14 | 1.38 | 1.96 | 3.39 | 2.14 |

| SHARES & EARNINGS | |||||||

| Price earnings ratio | times | (60.58) | 3.36 | 4.58 | 3.32 | (1.53) | 58.21 |

| EPS | Rs | (0.12) | 2.76 | 2.99 | 2.36 | (1.04) | 0.09 |

| Cash dividend per share | Rs | – | 0.50 | 0.50 | 0.50 | – | – |

| Dividend yield ratio | % | – | 5.39 | 3.65 | 6.39 | – | – |

| Dividend payout ratio | % | – | 18.12 | 16.73 | 21.19 | – | – |

| Dividend cover ratio | times | – | 5.52 | 5.98 | 4.72 | – | – |

| Breakup value per share (w/o surplus on revaluation of fixed assets) | Rs | 8.02 | 8.64 | 6.38 | 3.89 | 1.49 | 2.53 |

| Breakup value per share (including surplus on revaluation of fixed assets) | Rs | 8.02 | 8.64 | 6.38 | 3.89 | 1.55 | 2.53 |

| Market value per share – 31 December | Rs | 7.35 | 9.27 | 13.70 | 7.83 | 1.59 | 5.05 |

| Market value per share — High | Rs | 10.78 | 17.36 | 14.11 | 8.19 | 5.95 | 7.20 |

| Market value per share — Low | Rs | 6.70 | 8.31 | 6.75 | 1.59 | 1.15 | 4.20 |

| Market capitalization | Rs 000 | 11,129,423 | 14,036,701 | 20,744,639 | 11,856,242 | 2,407,589 | 7,646,746 |

NOTICE OF Annual General Meeting

April 21, 2021

Click on a thumbnail to view the full notice.

SCHEME OF ARRANGEMENT & STATEMENT TO THE MEMBERS OF THE COMPANY U/S 286 & 160(I)(B).

NOTICE OF MEETING

An Extraordinary General Meeting of the shareholders of Lotte Chemical Pakistan Limited will be held on 25th November 2014.

Click on the image to enlarge.

Download the Form for Proxy here.

FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 30 SEPTEMBER 2014

Download the un-audited financial results approved on 28 October 2014.

MERGER OF LOTTE CHEMICAL PAKISTAN LIMITED AND LOTTE POWERGEN (PRIVATE) LIMITED

Download the notice sent to KSE on August 26, 2014.

FINANCIAL RESULTS FOR THE QUARTER AND SIX MONTHS ENDING 30 JUNE 2014

Download the results approved on August 26, 2014.

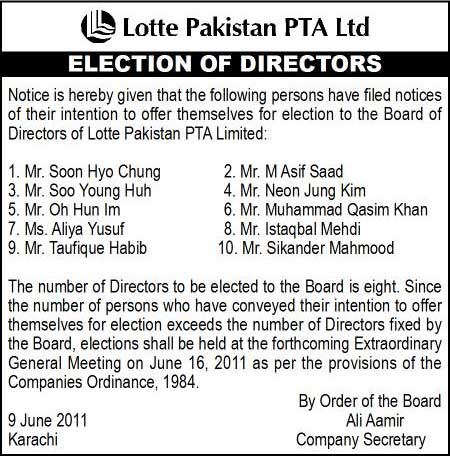

ELECTION OF DIRECTORS

Eight Directors were elected at an Extraordinary General Meeting held on June 20, 2014. Download the list of Directors.

NOTICE OF ELECTION OF DIRECTORS

NOTICE OF EXTRAORDINARY GENERAL MEETING

Download the Form of Proxy for the Extraordinary General Meeting here.

|

|

RESULTS LETTER Q1, 2014

Board meeting: The Board of Directors in its meeting held on 24 April 2014 at Karachi has approved the un-audited financial statements of the Company and consolidated for the first quarter ended 31 March 2014.

CHANGE OF CHIEF EXECUTIVE

April 25, 2014

This is to inform you that Mr. M Asif Saad will be stepping down as Chief Executive and Director of Lotte Chemical Pakistan Limited and its subsidiary, Lotte Powergen (Pvt) Limited, with effect from close of business on 3rd April 2014 and Mr. Jung Neon Kim, Executive Director, will be taking over as Chief Executive with effect from 1 May 2014 for the remainder of Mr. Saad’s term as director which expires on 22 June 2014.

NOTICE OF MEETING

March 4, 2014

Click on a thumbnail to view the full notice.

|

|

FORM OF PROXY

Download the Form of Proxy for the 23rd Annual General Meeting.

RESULTS LETTER Q4, 2013

January 28, 2014

Board Meeting: Financial Results for the Year Ended December 31, 2013.

RESULTS LETTER Q3 2013

October 28, 2013

Board Meeting: Financial Results for the Quarter and Nine Months Ended September 30, 2013.

NOTICE OF MEETING

March 4, 2013

Click on a thumbnail to view the full notice.

|

|

Forms for the Fifteenth Annual General Meeting are available here.

NOTICES

January 30, 2012

Click on a thumbnail below to view the full notice.

|

|

NOTICE FOR ELECTION OF DIRECTORS

June 9, 2011

Please direct all enquiries/complaints to Mr. Waseem Siddiqui, Assistant Manager Shares, using the form provided below. Required fields are marked with an asterisk (*).

Contact the SECP.

Last Updated on March 24, 2021